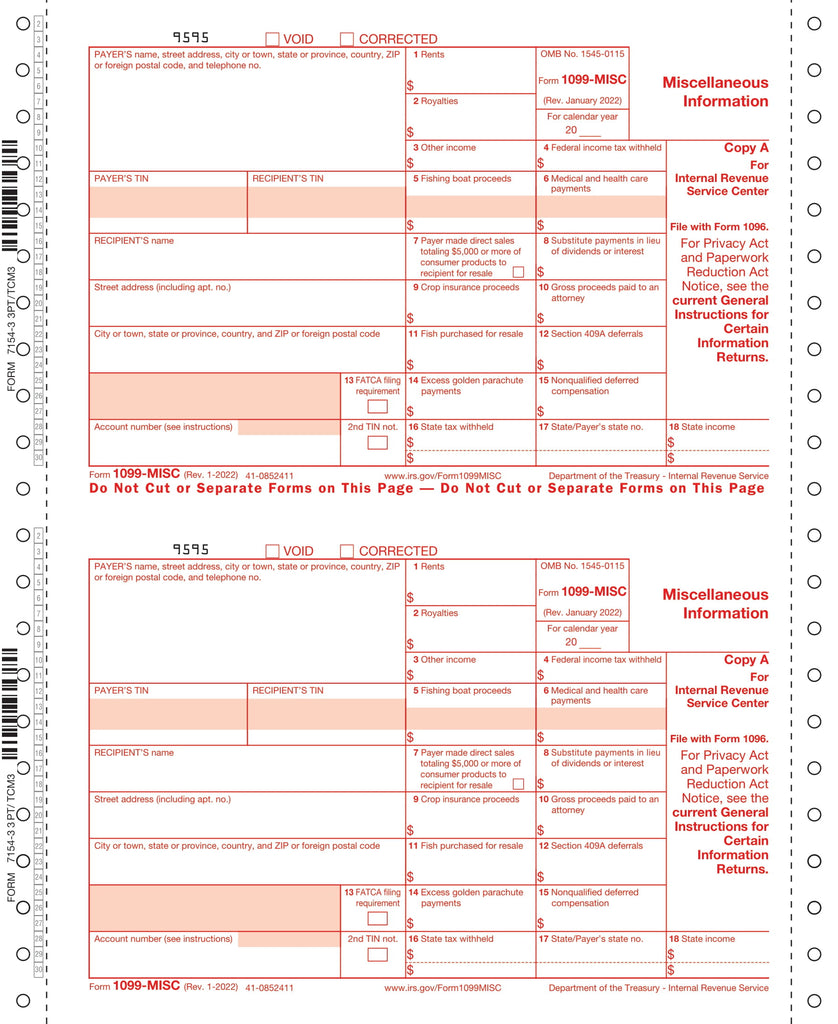

1099-MISC, 3-Part, 1-Wide, Continuous

$ 0.61

1099-Misc Tax Form Carbonless - 3 Part

Tax Form TC-M3

Tax Form 71543

Minimum order 50.

For use in reporting rents, royalties, prizes and rewards, fees, commissions to non-employees and health-care payments.

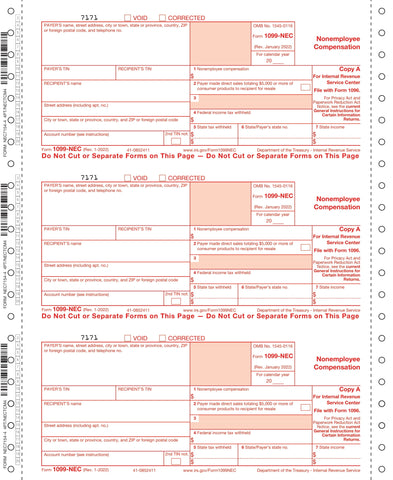

Note: 1099-MISC - NO longer used for Non-Employee Compensation. If you typically file any 1099-MISC forms (with Box 7 completed), you will need to file Form 1099-NEC for tax year 2020. Data currently reported in Box 7 (Nonemployee compensation) of Form 1099-MISC for tax year 2019, will be required to be reported in Box 1 of Form 1099-NEC for tax year 2020.

1099-MISC Miscellaneous Income

Copy A, B, C

Continuous

For use with envelope DWMR or self-seal envelope DWMRS.

Also known as Greatland tax form CMIS053